Fair is Fair: Amazon Should Collect Sales Taxes From California Customers

Let me start this out by saying that I, like the rest of you, am NOT a fan of paying taxes...income taxes, sales taxes, property taxes, payroll taxes, you name it! And my family is a frequent customer of Amazon.com. But as much as I dislike taxes and like Amazon.com, Amazon and other large out-of-state retailers should be collecting sales taxes from California customers. Fair is fair.

Let me start this out by saying that I, like the rest of you, am NOT a fan of paying taxes...income taxes, sales taxes, property taxes, payroll taxes, you name it! And my family is a frequent customer of Amazon.com. But as much as I dislike taxes and like Amazon.com, Amazon and other large out-of-state retailers should be collecting sales taxes from California customers. Fair is fair.

Last week, the State of California said that it will start requiring out-of-state sellers to collect and remit sales taxes on sales to California residents when it can be shown that the retailer has any physical presence in California, including the presence affiliates who receive a commission by promoting Amazon on their websites.

Amazon in turn swiftly sent a letter to its 10,000 or so California affiliates and told them, sorry, we're cutting you off. Yes, because Amazon is being asked to start collecting sales taxes like its competitors (e.g. Best Buy, Target, Walmart, Barnes & Noble, Costco, et al) do, they are throwing their affiliates off the bus and using them as a pawn. That wasn't very nice of them.

Let's step back for a moment. California is one of 45 U.S. states with sales and use taxes. (The 5 without are currently Maryland, Alaska, Oregon, Montana and New Hampshire.) California requires sales taxes on tangible items, or anything that "can be seen, weighed, measured, felt or touched." There are exceptions for things like prescription drugs and groceries. Any retailer that has a physical presence, or "nexus" as they call it, such as a store, office or salesperson, must charge sales taxes and remit them to the state. Like it or not, that's the law and that's what they do.

But then there's the mysterious "Use Tax," which also applies to tangible goods, but for items purchased either outside of California (e.g. if you buy a TV in Oregon while on vacation) or from out-of-state vendors via the Internet. In other words, if you buy stuff from a company like Amazon that does not charge you sales tax, you are legally required to calculate and remit use tax on that purchase. "Use tax" is a terrible name for this tax; sounds like a tax for using something, not buying something.

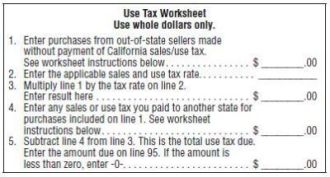

All you California Amazon.com customers, have you paid your use taxes? Or did you even know about them? Most people I mention "use taxes" to give me a blank stare. There's a whole section dedicated to payment of use taxes in the California Form 540 instructions. Without boring you with the instructions, the table is shown here.

All you California Amazon.com customers, have you paid your use taxes? Or did you even know about them? Most people I mention "use taxes" to give me a blank stare. There's a whole section dedicated to payment of use taxes in the California Form 540 instructions. Without boring you with the instructions, the table is shown here.

The new affiliate nexus law signed by Governor Brown will exempt any out-of-state retailer that sells less than $500,000 into California or less than $10,000 through its California affiliates. It is not clear how much business Amazon does in California but with $34.2 billion 2010 sales, including $18.7 billion in North America, it must be a sizeable amount. Proponents of this new law say that it could generate $200 million in taxes that currently are uncollected and unpaid, which hurts all Californians.

Let's look at the fairness issue. Amazon did $34 billion in 2010 sales and has a market value of $95 billion. One competitor, Best Buy, did $50 billion in 2010 sales and has a market value of $12.4 billion. Best Buy's sales are 50% greater than Amazon's, yet its market cap is roughly 1/8th of Amazon's. Why? Amazon has an inherent advantage of no brick and mortar and thus drastically less overhead. Not to mention, Amazon is an extremely well run company. Inversely, Best Buy has thousands of stores around the world that are costly to manage and maintain. And Best Buy charges sales taxes on California purchases; Amazon does not.

Why does Amazon refuse to collect sales tax like other retailers in California? It wouldn't cost them much to do. And sales taxes are just a passthrough; collect them and remit them, no impact on the bottom line.

Well, let's look at this example. If I purchased an Apple iPod Nano 16GB Graphite today on BestBuy.com, I'd pay $174.99 plus $5.99 shipping and $15.31 sales tax, for a total of $196.29. The same item at Amazon is $164.95 plus $5.58 shipping and $0 sales tax, for a total of $170.53. I'm "saving" $15.31 in sales taxes at Amazon (though as we know I still owe the tax). This is quite a nice competitive advantage for Amazon that they don't want to give up.

There are 2,776,000 retail jobs in California, or about 1/5th of California employees. The California Retailers Association says this out-of-state Internet retailer sales tax loophole eliminated 18,000 California jobs, $4.1 billion in sales and $7.2 billion in economic activity in 2010.

Come on, Amazon, Overstock and other large out-of-state retailers who sell to Californians. Do your civic duty. Collect sales taxes like your competitors, remit them, retract the cancellations sent to your California affiliates and move on to other things. We like you and want to continue using you. Don't give us a reason not to.

And to the California State Board of Equalization, you do a LOUSY job of explaining to the public what use taxes are. It wouldn't surprise me if only 3% of the population understands the concept (well maybe 6% now that it is covered in Conejo Valley Guide).

Lastly, for you taxpayers, another item in the enacted budget is a "Use Tax Look-Up Table" that will simplify the process of collecting use taxes based on your Adjusted Gross Income. This is similar to what some other states do and is much easier than requiring you to do your own calculation. But the beancounters calculate this would generate a measly $7 million/year in additonal revenue.

That is all....for now...

Read more about California sales and use taxes dropping by 1% on July 1, 2011.