Throwback Moment: Price-Costco Store Opened in Westlake Village in August 1996

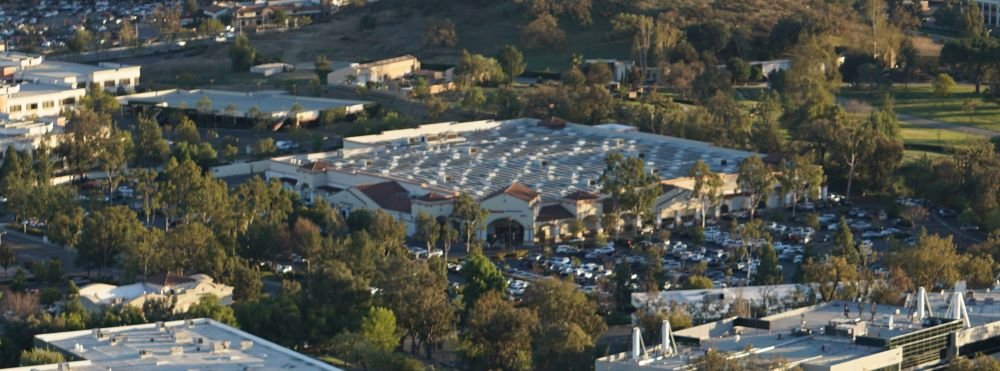

/Costco Westlake Village seen from the North Ranch Open Space

Let’s face it…the Westlake Village Costco is one of the most popular places to go in the Conejo Valley. Always teeming with shoppers and sample hunters, it seems the local community would be lost without this store.

Let’s go back in time to when it opened…

The store opened its doors as PriceCostco on Thursday, August 8, 1996 at 5700 Lindero Canyon Road. Price-Costco was formed in 1993 with the merger of Price Club (which opened its first location on July 12, 1976 in San Diego) and Costco (which opened its first warehouse in Seattle on September 15, 1983).

One of my guilty pleasures…the $1.50 Costco Hot Dog and Soda deal.

Who remembers PriceCostco? The merger between the two companies took place in 1993. Price Club was being pursued by Walmart to merge with the Sam’s Club warehouse store chain. Price opted to merge with Costco instead. And wallah…PriceCostco was created. At the time, there were 206 locations. As of August 2022, there are 838 Costco locations worldwide.

The prior management team from Price Club, the Price brothers, left the company in 1994 and in 1997, “Price” was dropped from the name and it became Costco.

According to a 1/4/96 VC Star article, PriceCostco purchased the 30 acre site at Lindero Canyon Road and Westlake Boulevard in Westlake Village for $9.3 million, with plans for a 136,000 sq ft Price Club.

Local residents were against the addition of the warehouse club to the community. City Council approved the project as it was allowed as part of a long-term commercial development agreement in place with owners of the property. However, the city stipulated approval was required for specifics like exterior color scheme, roofing materials in earth tone colors, etc.

Flashback to 2009: There were high hopes for a 2nd Conejo Valley Costco location in Newbury Park at the corner of Grande Vista Drive and Academy Drive. But according to a T.O. Acorn article on 1/29/09, Costco could not make the project economically feasible as it was “unable to finalize a lease for the site.”

It is clear that Costco prefers to own its land and buildings, not lease them. In Costco’s annual Form 10-K filing for the fiscal year ended August 29, 2021, fully 79% of its 815 warehouses around the world were owned; the remaining 19% were leased.

Lowe’s and LA Fitness were able to work a deal with owners of the property in Newbury Park and the City of Thousand Oaks Planning Commission approved the project to build locations there at a meeting on 12/13/10. Lowe’s Newbury Park opened on July 4, 2019.